Coronavirus Impact on the Chlor-alkali Market

- Personal Protective Equipment (PPE) must Comply with EU REACH

- The imbalance between supply and demand in chemical specialty products market

- FDA reopens Door to Respirators From Chinese Manufacturers

- Why China is emerging as a leader in sustainable and organic agriculture

- No time for 'America First'. Chinese coronavirus tests are good enough for the U.S.

- India partially lifts ban on export of hydroxychloroquine and paracetamol

- A limited closed-loop system in European plastic recycling industry due to the epidemic

- COVID-19 could lead to the worst growth in the Chemical Industry in 2020, BASF Predicts

- 10 Covid-busting designs: spraying drones, fever helmets and anti-virus snoods

- A Covid-19 Supply Chain Shock Born in China Is Going Global

- Coronavirus: China Having Trouble Exporting Medicine—But Not Fentanyl

- Germany amends export ban on medical protective materials

- Chemicals Perspective Focus: Crude oil drops low, which chemical prices fall to the lowest?

- The chemical industry became Finland's largest export

- Coronavirus outbreak takes heavy toll on India’s leather export trade

- China methanol imports may be hit as Iran battles rising coronavirus cases

- Agri-chemical industry watching COVID-19

- nCOV-2019 In China: Risks and Opportunities for Chemical Industries

- Coronavirus threatens UK paracetamol shortage

- ★Chemical sourcing support to revive manufacturing and production applications

- Indonesia Government plans to ease import procedures as manufacturers look beyond China for sources

- China Exports of Organic chemicals

- BASF warns of 'significant impact' on business from coronavirus

- How Globalization and China’s Economic Crisis Might Jeopardize Precarious Medical Supply Chains

- China to implement all-around management on safe production of hazardous chemicals: MEM

- Could China's coronavirus outbreak hurt the global drug industry?

- The Coronavirus COVID-19 is expected to have a limited impact on global upstream cost markets

- Japan chemical makers to tap AI in joint materials project

- China Solicits Comments on Food-Contact Substances

- Global chems trade slows on coronavirus uncertainty

- JCB – how the coronavirus can bring the UK supply chain to its knees

- The Virus Is Interrupting Supply Chains From Watches to Lobsters

- Nouryon cuts production in China as coronavirus dampens demand

- Coronavirus could cut Chinese base chemicals demand by 4 MMt, says IHS Markit

- Demand for Basic and Specialty Chemicals Continues to Grow

- India Government to announce measures to deal with coronavirus impact on industry

- Coronavirus Impact: A long shutdown in China will leave a mark on key sectors

- Coronavirus poses greater threat to China’s petrochemicals industry than SARS

- Coronavirus Impact on the Chlor-alkali Market

- Sanofi announces it will work with HHS to develop coronavirus vaccine

- Uncertainty clouds China's dream of making ethylene from ethane

- Some vaccines against covid-19 enter animal testing phase

- China announces anti-dumping cases on some chemicals

- China responds to epidemic situation and stabilizes export trades

- Five suggestions from Sinopec Federation to fight the coronavirus and ensure economic operation

- A chemical company in Shanghai urgently coordinated customs to speed up clearance procedures

- Coronavirus impact on India’s trade, construction, auto and pharma likely to be worst-hit

- INSIGHT: PVC tightens globally in key markets as supply shocks squeeze exports

- WHO says vaccines against novel coronavirus 18 months away

- Coronavirus throws up crop chemical concerns as China's supply chain disrupted

- Two groups use artificial intelligence to find compounds that could fight the novel coronavirus

- Coronavirus May Reduce Chinese Base Chemicals

- China's Coronavirus impacting Indian pharma manufacturing

- The impact of the coronavirus on the Chinese polyester industry

- Impact of the Coronavirus Outbreak on China's Acrylates Industry

- China chemical production curtailed amid Coronavirus restrictions

- A summary of reagents, instruments, consumables for coronavirus detection

- ★MOLBASE Virus-Related Materials Supply and Demand Collection

- State pharma firms step in to curb spread of deadly pathogens

- How can the international community cope with the epidemic for common human security?

This is a special update on the effect of the coronavirus crisis on the chlor-alkali market in China. Because the situation is still evolving, it is impossible to predict the full impact of the crisis. Nevertheless, this report provides IHS Markit's current qualitative assessment of the impact to date on the chlor-alkali supply and demand balance in China and commentary on our assessment of certain ramifications on the chlor-alkali market outside China.

Coronavirus impacts on chlor-alkali supply in China

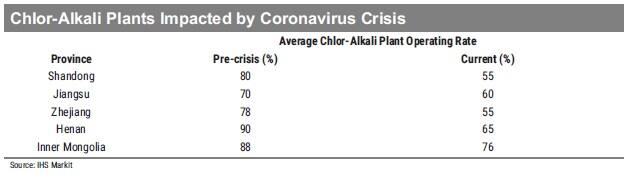

Chinese chlor-alkali plant operating rates have declined due to the virus crisis. Additionally, at least four plants with combined annual capacity slightly over 1.5 million tons (chlorine basis) are confirmed to have shut down, two in Anhui province, one in Hubei province and one in Shandong province. Average operating rates across China were near 80% before the Chinese New Year holidays. Since the virus crisis emerged, average operating rates across the country have dropped to approximately 65%. However, the impact on operating rates varies significantly by province, depending on the severity of the local virus impacts. For example, the impacts on average operating rates in five key provinces are shown in the table below. IHS Markit Asian analysts expect continued operating rate decreases; market discovery suggests that there is potential for additional end-user plant curtailments or shutdowns as finished goods inventories rise.

Decreased chlor-alkali operating rates are the result of virus-related demand erosion and product movement logistics constraints, as well as rising producer inventories. IHS Markit expects logistical constraints to put further downward pressure on operating rates until the crisis abates. Worker shortages, a lack of drivers, and road blockages are collectively contributing to challenges associated with moving product. Logistics challenges are not expected to be resolved immediately when workers are able to return to their homes from destinations where they spent the Chinese New Year holidays because they will be subject to a 14-day quarantine period prior to returning to their workplaces.

IHS Markit discovery indicates that reduced Chinese chlor-alkali plant operating rates are impacting availability of caustic soda for the export market. One Chinese producer reported that they have no caustic to offer to the spot market because they are operating at only 50% rates and all their production is therefore directed to the domestic market, albeit a slow domestic market. Another producer reported high inventories because they are unable to make regular shipments to Guangdong in Southern China because Guangdong province buyers' inventories are high. Landlocked non-integrated chlor-alkali producers in Shandong province are also plagued by low domestic demand and inability to move their product due to logistics constraints.

IHS Markit anticipates negative market impacts to continue with respect to Chinese chlor-alkali production and demand at least until the end of February with additional producers potentially being forced to shut down completely.

Coronavirus impacts on chlor-alkali supply outside China

Coronavirus impacts on chlor-alkali supply outside China

China does not import a significant amount of liquid caustic soda. Therefore, decreased caustic soda demand in China has not directly impacted chlor-alkali operating rates in other Northeast Asian countries. However, integrated chlor- vinyls producers in South Korea, Japan and Taiwan report that they are unable to export vinyls to China due to the impact of the virus on Chinese vinyls demand. (Global Vinyls Report clients can find detailed information on the coronavirus crisis impact on the vinyls market in the February 13, 2020 GVR Special Focus Report.) Japanese integrated chlor-vinyls producers are reported to have reduced chlor-alkali operating rates to account for lower chlorine demand for vinyls production associated with exports to China. Constraints on non-China Northeast Asian vinyls production has impacted caustic soda availability for the regular Asian spot market. South Korean suppliers report that they are sold out of spot caustic soda for March shipment; Taiwanese producers also have no spot caustic soda available. Early reports suggest that spot caustic soda may be constricted from Indonesia, as well.

Coronavirus impacts on chlor-alkali demand in China

All chlor-alkali end-use segments in China have been negatively impacted by the coronavirus. Decreased demand in chlor-alkali consumption segments is attributable to a lack of workers, product delivery logistics challenges, and rising finished product inventories. Caustic soda and chlorine end-use plants that were shut down for the Chinese New Year generally remain down.

Average alumina production rates have declined from approximately 80% prior to the onset of the crisis to about 75% now.

Viscose fiber production rates have dropped by approximately 10% due to the crisis, from about 80% on average to 70% on average.

IHS Markit has been unable to quantitatively assess the impact of the coronavirus on the pulp and paper market in China, but discovery indicates that the sector, which was already running at lower than normal rates due to market pressures prior to the crisis, is experiencing further slowdown as finished goods inventories are building, including at converters that consume imported pulp. Pulp and paper operations in Hubei province, the epicenter of the outbreak, have halted along with 26 factories. The Hubei operations will not be allowed to startup before Feb 14, 2020. One bright side for producers, the demand for face masks has caused tissue paper producers to switch to mask production to meet demand. Overall, we anticipate further production deterioration in the pulp and paper sector by the time the crisis passes.

Other chlor-alkali end-use segments reported to be operating at low rates in China include chemicals production and printing and dyeing.

Coronavirus impacts on chlor-alkali demand outside China

Prior to the onset of the coronavirus crisis, market pulp producers outside China forecasted demand improvement. However, optimism has waned as producers outside China wait to feel the impact of the virus in the supply chain. Non- Asian pulp producers do not report downward operating rate adjustments to date. The two-week strike at pulp mills in Finland catalyzed pulp price increase announcements, but the impact of reduced demand in China may counter the strike impact and mute upward pulp price momentum potential. With pulp mills back to normal operations now in Finland, the true impact of decreased Chinese demand associated with the coronavirus crisis may become more transparent.

Pulp market experts believe that supply chain lags will delay the realization of coronavirus impacts on the global pulp sector because the feedback from current non-integrated tissue and paper mill finished goods inventory constraints is expected to take a month or two to translate into a need for rate curtailments in Canadian, South American, and European mills.

Many Asian caustic soda consumers that buy Chinese caustic soda report shipment delays because of the virus-related logistics constraints in China. Distributors indicated to IHS Markit that they have 14 day or more waits for product from China. Asian consumers of Chinese manufactured products also report challenges getting stock from China. Printed circuit board (PCB) manufacturers in Taiwan and other non-China Asian countries have been unable to ship their PCBs to China, especially to factories in Guangdong province, because the manufacturing facilities in China remain out of service. Therefore, Asian caustic soda and hydrochloric acid consumption outside China is negatively impacted by the virus crisis.

Coronavirus impacts on chlor-alkali trade

Indonesia, Singapore, Malaysia and Philippines have imposed quarantines on ships arriving from Chinese ports. Ships that have been in Chinese ports within 14 days prior to arrival in the Southeast Asian ports are required to quarantine for 14 days at anchorage before berthing.

A chemical tanker carrying liquid caustic soda from Japan that arrived in West Kalimantan, Indonesia was quarantined because 7 of 22 crew members have coronavirus symptoms. The buyer may need to alternatively source caustic soda.

Source from ihsmarkit